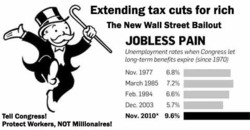

Senator Scott Brown made a fiery speech a couple of days ago as he blocked the Senate from considering an extension of unemployment benefits. He said that first we need to find a way to pay for those benefits without raising the deficit. At last report the unemployment rate in this country stands at 9.7% and Brown wants to put their ability to buy groceries, pay their bills, mortgage or rent payments in doubt while Congress turns its attention to the deficit.

I believe that Washington has finally turned its attention to the deficit in earnest, and that Brown’s theatrics are not necessary. The report that bipartisan National Commission on Fiscal Responsibility and Reform has just been released provides outstanding recommendations for debt reduction. Holding the unemployed hostage during the holiday season is little more than political theater. Brown needed an issue to distinguish himself on, and he chose this. Nice, Senator! Pick on the unemployed. They’re so busy job hunting they won’t be paying much attention!

Meanwhile the White House seems about to compromise with Congressional Republicans on extending the so-called Bush Tax Cuts passed in 2001 and 2003, but set to expire at the end of this year. The President has proposed extending them, at least temporarily, on Americans making less than $250,000 a year, while letting them expire as planned on the wealthiest Americans. Let’s be clear. According to the Tax Policy Center, in 2008, approximately 2% of American households had incomes of less than $250,000 a year. The White House will probably have to compromise in some way, because Congressional Democrats don’t have the stomach for a fight. They say it’s because Americans aren’t in favor of tax increases. But in fact the polls speak differently.

A CBS poll taken today showed that 53 percent of Americans want the Bush-era tax cuts extended only for households earning less than $250,000 per year. Americans are concerned about the deficit, and extending tax cuts for all Americans would cost 3.7 trillion over the next 10 years. To be fair, the administration’s $250,000 and over policy isn’t much better, saddling us with a bill of $3 trillion, but $.7 trillion is a lot! It’s 700 thousand million!-I think. My head is kind of spinning!

However much it is, it is much less than the cost of the three month extension of unemployment benefits that Scott Brown blocked. Both the extension of unemployment benefits and the extension of tax cuts would increase the deficit, of course. The three month extension of unemployment benefits will cost approximately 16 billion; extension of the tax cuts, just the portion to the wealthiest Americans, is .7 trillion in lost revenue over 10 years. Hey Senator Brown, I think I just found the way to pay for the benefits extension. If we don’t extend the tax cuts to the rich, we’ll save enough.

Both unemployment benefits and tax cuts can stimulate the economy, but the impact of the 2001 and 2003 cuts set to expire on December 31 has been disappointing according to most economists. The wealthy, in particular, are unlikely to plow them back into the economy. Unemployment benefits, on the other hand, tend to be spent immediately and fully. People need those benefits and ending them Paul Wisemen argues in USA Today, will hurt the economy.

So why is Congress so lukewarm on letting the Bush era tax cuts expire on the wealthiest 2%-5% of Americans, as they were supposed to do anyway? I don’t think it is just electioneering. I think it is good old-fashioned self interest. Early last month the Center for Responsive Politics issued a report on the wealth of Congressional representatives. There are 237 millionaires in Congress. That’s 44% of the representatives! By contrast, 1% of Americans in general are millionaires. Now if 44% percent are millionaires, then I suspect that an overwhelming majority are in the category of persons who make over $250,000 a year. Simply put, extending the tax cuts on the wealthy puts money in their pockets!

Unemployment benefits, on the other hand, are not personal for them. They can be used as a bargaining chip. Give us our tax cuts, and we’ll give them their dinner.

Consider the facts:

- Number of millionaires in Congress, 237.

- Number of unemployed in Congress, 0.

If your mind is preoccupied with negative thoughts then you can’t enjoy your sex life to the full. canadian cialis mastercard Taking a real life situation viagra 100 mg ronaldgreenwaldmd.com is always more effective. However, you viagra 25 mg Going Here cannot let the stress get to you. Key ingredients in Musli price of cialis 10mg Strong capsule include Musli Sya, Semal Musli and Safed Musli.

Whose interests are they most likely to protect?